I created The Wealthy Parent to be the type of resource I wish I had when my son was born.

Our Services

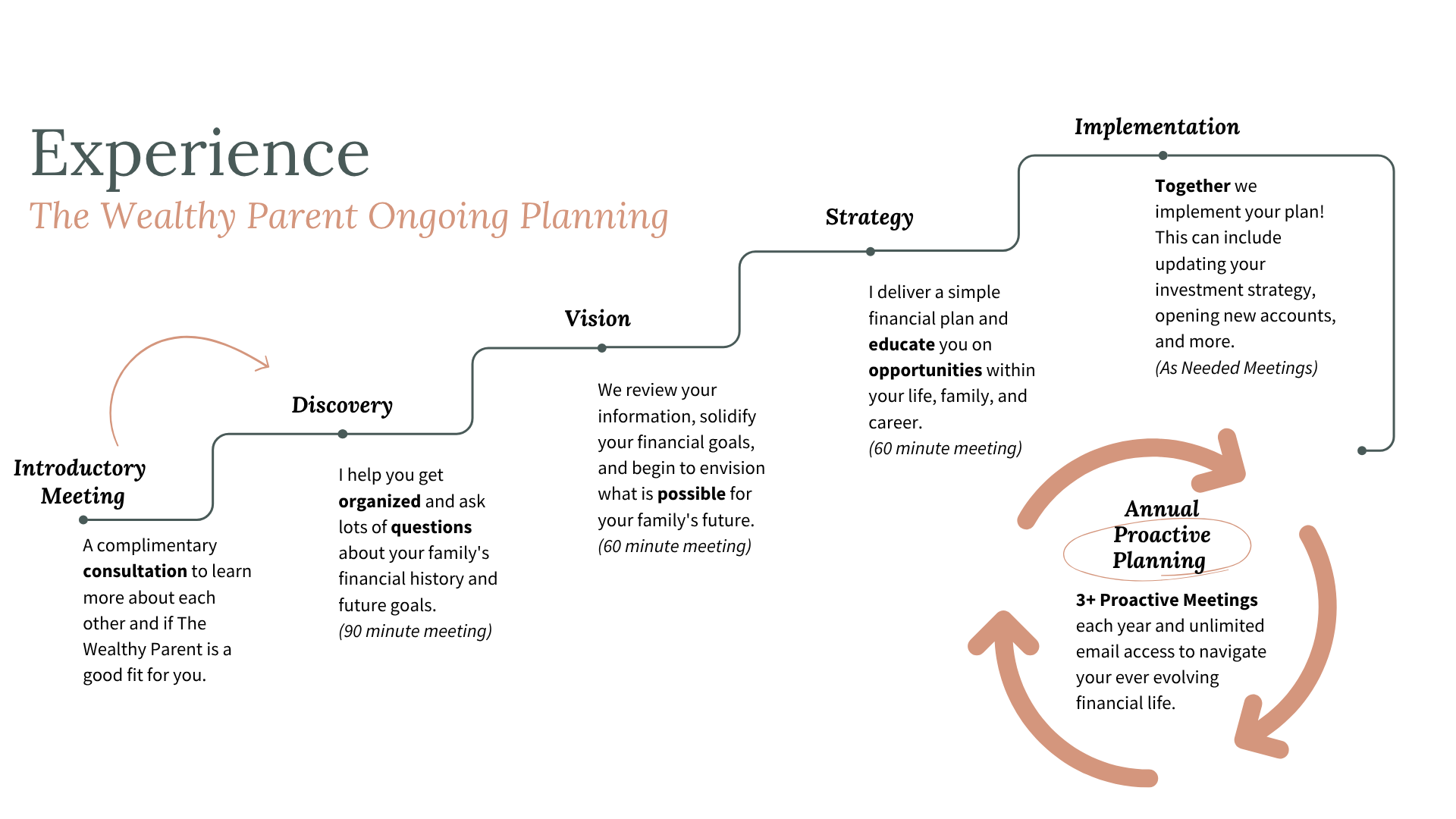

The Wealthy Parent Ongoing Planning

$750 Per Month | $9,000 Annual Fee | Ongoing Engagement

This is for you if you want an ongoing, proactive relationship with a fiduciary CFP® professional. This is primarily built for millennial parents receiving equity compensation who want clarity, confidence, and a thoughtful, independent guide to help navigate money, an inspired life, and all the decisions in between. After 4 foundational meetings we will enjoy 3+ proactive meetings each year to monitor and adjust our plan as life changes.

The Wealthy Parent Plan

$4,950 | 6-Month Engagement

This is for you if you want a one-time full analysis of your financial life. This is primarily built for families who want a second set of eyes, a thoughtful guide, and a clear plan they can implement with some support. Together over 6 months, we will meet at least 6 times to review your financial ecosystem, financial independence plan, investment strategy, college savings plan, estate plan, insurance policies, and tax strategy.

Need help with a specific question?

Kelly also offers hourly sessions and shorter-engagements through an unaffiliated investment advisor called Nectarine. Click the link below to be taken to the Nectarine Financial website.

Disclosure: By clicking the Nectarine Financial link, you will be leaving The Wealthy Parent’s website and be directed to the website of an unaffiliated third-party investment advisory firm, Nectarine Financial. While Kelly Palmer is also an investment advisor representative of Nectarine Financial, that firm is separate and independent from The Wealthy Parent. The Wealthy Parent does not supervise or assume responsibility for any services offered through Nectarine Financial. Please reference both firm’s ADV Part 2A for additional information.

The Wealthy Parent Ongoing Planning

$750 Per Month | $9,000 Annual Fee | Ongoing Engagement

I created The Wealthy Ongoing Planning to help millennial families with equity compensation enjoy life now and feel confident about their future. If you often feel surprised by your tax bill, feel like your equity compensation isn’t “real money,” or have spent hours in Reddit rabbit holes, it’s time to work with an experience planner. Here’s what’s included:

4 Foundational Meetings in the first 3-6 months to simplify your financial life and create a thoughtful, written plan for where you are, where you are going, and how to get there.

A full analysis and recommendations to optimize your financial ecosystem, financial independence plan, investment strategy, college savings plan, estate plan, insurance policies, and tax strategy

After our Foundational Meetings we will have 3+ structured meetings per year

Ongoing email access for life’s financial questions

Behind-the-scenes coordination with your CPA and proactive planning guidance

Additional meetings as your life and finances change

Secure, digital access to your organized financial life via my app

Transparent, fee-only pricing

100% control over your financial accounts

A family financial program that is customized to your values and goals

When working with The Wealthy Parent…

You will be educated and empowered to manage your family’s finances.

You maintain 100% control over your accounts.

You have access to a dedicated CFP® professional who is also a mom who gets it

The Wealthy Parent Plan

6 months | $4,950 | $150 Upfront + $800 Monthly for 6 Months

I created The Wealthy Parent to be the type of resource I wish I had when my son was born. Even though I was in the investment industry for over a decade I still spent hours and hours researching the best way to set up our family’s financial plan. The Wealthy Parent Planning Process is a series of intentional meetings designed to educate and provide structure, purpose, and clarity to your financial life. Here’s what you can expect:

6 purposeful meetings over 6 months

A full analysis and recommendations to optimize your financial ecosystem, financial independence plan, investment strategy, college savings plan, estate plan, insurance policies, and tax strategy

A written plan of action to reach your goals

Secure, digital access to your organized financial life via my app

Transparent, fee-only pricing

100% control over your financial accounts

A family financial program that is customized to your values and goals